House GOP members want info on IRS’ alleged AI ‘financial surveillance’ of citizens

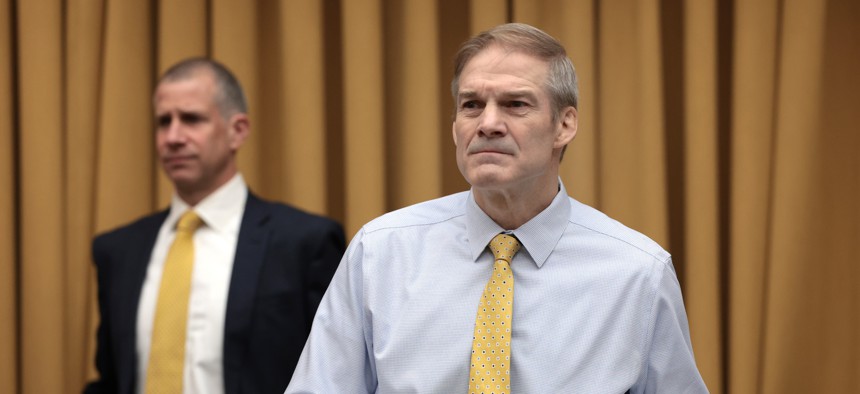

House Judiciary Committee Chairman Jim Jordan, R-Ohio, and Rep. Harriet Hageman, R-Wyo., requested more details about the tax agency’s use of artificial intelligence in its enforcement efforts in a letter published Wednesday.

House Republicans increased their scrutiny of the IRS’ plans to deploy artificial intelligence to aid its enforcement efforts Wednesday, penning letters to both Treasury Secretary Janet Yellen and Attorney General Merrick Garland calling for more information on the agency’s use of the emerging technology.

Pointing to a Feb. 21 tweet from conservative filmmaker James O’Keefe — which alleges an employee of the agency’s Criminal Investigation Unit claimed that the IRS uses AI networks controlled by the “Department of Justice and the inspector general” to access U.S. citizens’ bank accounts — House Judiciary Committee Chairman Jim Jordan, R-Ohio, and Rep. Harriet Hageman, R-Wyo., cited their oversight roles to request information about the use of AI in revenue enforcement.

Jordan and Hageman, both members of the House Select Subcommittee on the Weaponization of the Federal Government, said because of the claims made by a man identified as Alex Mena, they are requesting information about the IRS’ AI usage dating back to Jan. 1, 2021.

“The Committee and Select Subcommittee have reason to believe that the IRS is working with other federal agencies to conduct this AI-powered warrantless financial surveillance,” the letter said. “Additionally, the Treasury Department's Feb. 28, 2024, press release makes clear that the Treasury Department's Office of Payment Integrity (OPI) has a 'strong partnership with federal law enforcement agencies,' which has 'led to multiple active cases and arrests.' These allegations are particularly concerning given the IRS's track record of targeting, harassing, and intimidating American taxpayers and journalists and history of ignoring due process requirements when investigating taxpayers.”

The Feb. 28 press release details the recovery of $375 million in fiscal 2023 through the Treasury Department’s Office of Payment Integrity use of AI-enabled enhanced fraud detection to mitigate check fraud.

Though the OPI sits within the Bureau of the Fiscal Service, separate from the IRS, Jordan and Hageman note that the Feb. 28 statement credited the “enhanced AI process and OPI’s strong partnership with federal law enforcement agencies have led to multiple active cases and arrests with law enforcement,” and tied them to the allegations in the O’Keefe video.

“The use of AI technology to actively monitor millions of Americans' private transactions, bank accounts and related financial information—without any legal process—is highly concerning,” the letter said. “This kind of pervasive financial surveillance, carried out in coordination with federal law enforcement, into Americans' private financial records raises serious doubts about the IRS's—and the federal government's—respect for Americans' fundamental civil liberties.”

The pair requested documents and communications referring to the Treasury Department’s use of AI, large language models and machine learning to monitor citizens’ financial information, as well as a transcribed interview with Mena by 5 p.m. on April 3.

The letter comes as Reps. Clay Higgins, R-La., and Eric Burlison, R- Mo., introduced legislation last week that would place limits on the IRS from conducting an audit based on AI-enabled analysis and would require any taxpayer investigation be initiated by an IRS staff investigator.

IRS Commissioner Danny Werfel detailed the agency’s plans last fall to audit 75 large partnerships — each with assets over $10 billion on average — that were selected with the help of an AI tool.

In response to the allegations, the IRS said on Friday that it "respects taxpayer rights and uses artificial intelligence to better identify indicators of noncompliance, including complex noncompliance involving corporate and partnership structures. Any insinuation that the IRS is using artificial intelligence to monitor everyday taxpayers is completely false."