Trump Formalizes 2019 Pay Freeze Proposal, Revives Benefits Cuts

The freeze is coupled with a $1 billion interagency fund to reward high performers as a first step in moving the civil service toward pay for performance.

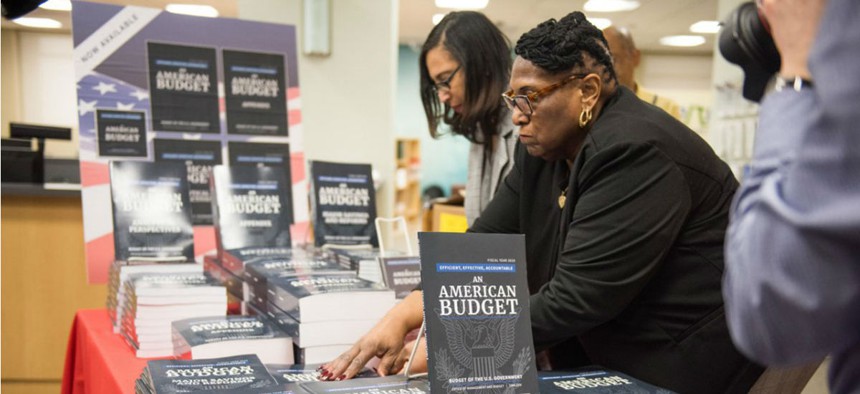

The Trump administration announced Monday that it will seek a pay freeze for all civilian employees in 2019, confirming a plan long expected from the White House.

The administration's fiscal 2019 budget proposal released Monday by the Office of Management and Budget also includes a number of provisions that would cut federal workers’ retirement and other benefits.

The budget describes the pay freeze plan as the first step in moving the civil service to a pay for performance system, pairing the freeze with a $1 billion interagency fund to reward high performers.

“This [fund] will replace the across-the-board pay raise that provides federal employees with increases irrespective of performance with targeted pay incentives to reward and retain high performers and those with the most essential skills,” officials wrote in a fact sheet accompanying the budget.

In addition to freezing wages in 2019, Trump’s fiscal 2019 budget reintroduces a number of cuts to federal employees’ benefits and retirement programs that were proposed last year but went unimplemented by Congress.

The budget would require federal workers to contribute 1 percent more toward the Federal Employees Retirement System defined benefit annuity each year for six years, and it eliminates the FERS supplement for retirees under the age of 62, which is when Social Security kicks in.

The plan would reduce cost of living adjustments for employees and existing retirees in the Civil Service Retirement System by 0.5 percent, and it would eliminate COLAs for FERS employees and retirees altogether. And it would change the formula that determines future federal retirees’ defined benefit annuities to be based on the highest five years of salary, instead of the current “high three.”

The budget proposal also could have a significant impact on the Thrift Savings Plan, the federal government’s 401(k)-style retirement program. Under the plan, the G Fund, which is made up of government securities and currently has a statutorily mandated annual interest rate of 2.25 percent, would be based on the yield of the three-month U.S. Treasury bill, which is 1.03 percent per year. TSP officials decried that idea last fall, saying it would make the portfolio “virtually worthless.”

Rethinking Retirement

The White House indicated that it plans to propose a seismic shift in the federal retirement system in the future that could remove defined benefit pensions altogether.

“The TSP is a particularly attractive benefit to young, mobile workers not intended to make a career of federal service,” officials wrote. “The budget, therefore, funds a study to explore the potential benefits, including the recruitment benefit, of creating a defined-contribution only annuity benefit for new federal workers, and those desiring to transfer out of the existing hybrid system.”

American Federation of Government Employees National Vice President Philip Glover said such a plan could be disastrous for employees as they approach retirement.

“I’m retired law enforcement from the Bureau of Prisons, and I can tell you in 2001, right after 9/11, I lost $65,000 in my TSP overnight,” he said. “In 2008, I lost $45,000 almost overnight. That’s a part of my retirement that I never made up before I actually retired, and that annuity we receive is what makes it a stable system for someone like me to retire on.”

The proposal also features plans to change other federal employee benefits. It would do away with the current leave system, which offers different categories of time off for regular leave, sick days and vacation, in favor of one category of Paid Time Off, which would effectively reduce the amount of leave workers receive each year.

And the Office of Personnel Management would change how it determines the employer contribution portion of the Federal Employees Health Benefits Program, shifting away from the current 72 percent of the weighted average of all plan premiums with a 75 percent cap.

“Under this proposal, the government contribution would range between 65-75 percent depending on a plan’s performance,” officials wrote. “This proposal would encourage enrollment in high-performing health plans.”

According to the budget, this change to FEHB premium contributions would save more than $2.7 billion over the next decade.

J. David Cox, national president of AFGE, told reporters Monday that Trump’s budget is a significant threat to federal employees’ livelihood, particularly following years of austerity during the Great Recession.

“Federal workers already make 5 percent less in inflation-adjusted terms than they did at the beginning of the decade,” Cox said. “If we don’t stop the pay freeze for 2019, they will have given up $246 billion in wages and benefits since 2011. No other group has lost more to deficit reduction than the federal workforce.”

In a statement, National Treasury Employees Union President Tony Reardon described the budget as a “full-scale assault” on the federal civil service.

“This should alarm every member of Congress and all Americans,” he said. “Weakening our civil service system and attacking the pay and benefits of federal workers will backfire and leave our country unable to tackle the complex issues we are facing.”